4 bedroom detached house

Shared ownership

Study

Detached house

4 beds

2 baths

1227

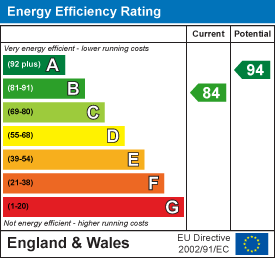

EPC rating: B

Key information

Tenure: Leasehold | 50% share | rental £464.92pcm | 120 yrs left

Council tax: Band E

Broadband: Super-fast 80Mbps *

Mobile signal:

EEO2ThreeVodafone

Features and description

- 50% Shared Ownership

- Subject To Criteria & Monthly Costs

- Immaculate Four Bedroom Detached

- Open Plan Kitchen Diner

- Beautiful Gardens, Garage & Double Drive

- EPC: B

- Council Tax Band: E

- Services: Mains GCH, Electric, Water, Drainage & Sewage

- Virtual Tour Available

Available to purchase a 50% share through a shared ownership scheme, purchasers must meet the eligibility and affordability criteria, further details of which are available within our brochure. A rent payable of £427.17 per month plus other charges are required in addition to mortgage payments

Welcome to Poplar Place located on the new St Andrews Gardens development, Morpeth. A stunning detached house built in 2019 and presented to an excellent standard offering the perfect blend of modern living and comfort. This property has 4 bedrooms, ideal for a growing family or those in need of extra space, the master having its own ensuite shower room/wc. To the ground floor there is an open plan kitchen diner area, the kitchen having integrated appliances and a utility area, a separate lounge, a much sought after home office, hallway and ground floor/wc. Outside, the gardens are presented to an equally high standard and there is a garage and double length drive to the side.

St Andrews Gardens is well located for access to Morpeth Town Centre along with access to the A1 for those commuting a travelling further afield. Within Morpeth there is an excellent range of amenities including high street and local shops, cafes, bars and restaurants along with health and leisure facilities and schooling for all ages.

For further details please contact us after reading the attached information.

Entrance Hall - Entrance door to the front leading to a welcoming hallway with stairs leading to the first floor and radiator.

Ground Floor Wc - Fitted with a wc and wash hand basin. Radiator and extractor fan.

Lounge - 3.33 x 4.67 (10'11" x 15'3") - Double glazed french doors to the rear garden and patio area, radiator.

Additional Image -

Home Office / Study - 2.17 x 2.3 (7'1" x 7'6") - To the front elevation with a double glazed window to front and radiator.

Kitchen Diner - 3.88 x 2.87 exc. utility area (12'8" x 9'4" exc. u - The kitchen area is fitted with a range of wall and base units with works surfaces and breakfast bar and integrated appliances to include a dishwasher, fridge freezer, double oven and hob and extractor fan. To the utility area there are further units and an integrated washing machine, double glazed window to the rear and a radiator. The kitchen area also has a radiator and double glazed french doors leading to the rear garden.

Additional Image -

Dining Area - 2.82 x 2.87 (9'3" x 9'4") - Open plan from the kitchen area with a double glazed window to the front and a radiator.

First Floor Landing - Access to loft.

Master Bedroom - 3.45 x 3.41 exc. wardrobes (11'3" x 11'2" exc. war - A spacious main bedroom with double glazed window to the front, radiator and built in wardrobes.

Additional Image -

Ensuite - Fitted with a wash hand basin, wc and mains shower in cubicle. Double glazed window to front, radiator and extractor fan.

Bedroom Two - 2.9 x 3.58 (9'6" x 11'8") - Double glazed window to the rear, radiator.

Bedroom Three - 2.89 x 3.17 max (9'5" x 10'4" max) - Double glazed window to the front, radaitor.

Bedroom Four - 2.7 x 3.16 max (8'10" x 10'4" max) - Double glazed window to the rear, radiator.

Bathroom/Wc - Fitted with a wash hand basin, wc and a panelled bath. Double glazed window to rear, radiator and extractor fan.

Externally - The front of the property has a beautifully maintained garden with lawn and driveway to the side providing off street parking and access to the garage.

The rear of the property has a further, very well maintained garden with patio and lawn with well established borders.

Additional Image -

Additonal Image -

General Information - These particulars are produced in good faith, and are set out as a general guide only, they do not constitute part or all of an offer or contract.

The measurements indicated are supplied for guidance only and as such must be considered incorrect. Potential buyers are advised to recheck the measurements before committing to any expense. No apparatus, equipment, fixtures, fittings or services have been tested and it is the buyer’s responsibility to seek confirmation as to the working condition of any appliances.

As the agent we have not sought to verify the legal title of the property and verification must be obtained from a solicitor.

Fixtures and fittings that are specifically mentioned in these particulars are included in the sale, all others in the property are specifically excluded.

Photographs are produced for general information and it must not be inferred that any item is included for sale within the property.

Material Information - Material information is no substitute for professional advice, and consumers should be aware that the information collected may not accurately reflect the full extent of the property condition which would be covered through a home survey.

Efforts have been made to ascertain as much information as possible with regard to material information but this information is not exhaustive and cannot be fully relied upon, purchasers will need to seek further clarification from their legal advisor.

Electricity Supply - Mains

Water Supply - Mains

Sewerage - Mains

Heating - Mains GCH

Broadband and Mobile - Available - including Ultrafast & Superfast broadband. Mobile signal likely/limited with some providers. (Ofcom Broadband & Mobile Checker August 2024).

Flood Risk - Rivers & Sea - Very Low Risk. Surface Water - Very Low Risk. Source gov.uk August 2024.

Planning Permission - There is currently no active planning permissions for Poplar Place. For more information please see -Checked August 2024.

Coalfield & Mining Areas - The Coal Authority indicate that this property is located on a coalfield. Your legal advisor will be able to advise you of any implications of this.

Tenure & Council Tax Band - Leasehold - We cannot verify the Tenure of the property as we do not have access to the documentation. Purchasers must ask their legal advisor to confirm the Tenure.

We have been advised the lease term is 125 years from 2019 and 120 years currently remain. As of August 2024.

Council Tax Band: E Source gov.uk August 2024.

Mortgages - Why not make an appointment to speak to our Independent Mortgage Adviser?

PLEASE NOTE:

Your home may be repossessed if you do not keep up repayments on your mortgage.

Oracle Financial Planning Limited will Pay Rickard 1936 Ltd a referral fee on completion of any mortgage application.

Floor Plan - This plan is not to scale and is for identification purposes only.

Google Maps - General Note - If you are using Google Maps, satellite or Street View please be aware that these may not show any new development in the area of the property.

Viewing Arrangements - BY PRIOR ARRANGEMENT THROUGH OUR MORPETH OFFICE[use Contact Agent Button]

Heylo Key Criteria - Key criteria are:

* Buyers must be at least 18 years old.

* Buyers must have a total household income under £80,000 (£90,000 in London).

* Buyers must meet the Homes England affordability and sustainability assessments (see the Homes England calculator guidance for further information).

* Buyers are expected to use any savings and assets towards the purchase of their home. This may mean selling assets such as bonds, shares, land and any other financial investments.

* Buyers in receipt of benefits are eligible for Shared Ownership provided they meet the Homes England affordability assessment (not all benefits are eligible).

* Self-employed buyers must be able to provide 2-years evidence of their income.

Correct at time of publication - August 2024

* Buyers must purchase the maximum share they can reasonably afford within the parameters of the Homes England calculator.

* Shared owners must be first time buyers or:

* Not currently own a home suitable for their housing needs.

* Sell a home not suitable for their housing needs before buying Shared Ownership.

* Own a non-residential property that provides their main income source.

* Buyers must have good credit history and must not have the following (for more information on acceptable credit for Home Reach please refer to the credit policy):

* A mortgage or rent arrears

* Other bad debts

* County Court Judgements

* Buyers must have a minimum 5% deposit towards the share they are purchasing

* Buyers may retain a portion of their savings to cover the costs of purchase and moving home (typically up to £5,000). This may include:

* Legal fees

* Stamp Duty Land Tax where applicable

* Mortgage application fees

* Valuation fees and any associated moving costs

Heylo - Key Information About Shared Ownership - INTRODUCTION:

When you buy a home through shared ownership, you enter into a shared ownership lease. The lease is a legal agreement between you (the ‘leaseholder’) and the landlord. It sets out the rights and responsibilities of both parties.Before committing to buy a shared ownership property, you should ensure you take independent legal and financial advice.This key information document is to help you decide if shared ownership is right for you.You

should read this document carefully so that you understand what you are buying, and then keep it safe for future reference.It does not form part of the lease. You should carefully consider the information and the

accompanying lease, and discuss any issues with your solicitor before signing the lease.Failure to pay your rent or service charge or your mortgage could mean your house is at risk of repossession Examples and figures provided in this key information document are correct at the time of issue but will change over time in accordance with changes in house prices and the terms of the shared ownership lease.

1. Heylo How Shared Ownership Works - 1.1 You pay for a percentage share of the market value of a home. You enter into a lease agreement with the landlord, and agree to pay rent to the landlord on the remaining share.

1.2 You can buy more shares in your home, which is known as ‘staircasing’. This is covered in section 6,‘Buying more shares’.

1.3 When you buy more shares in your home, the rent you pay goes down in proportion to the landlord’s remaining share.

1.4 You can rent out a room in the home at any time, but you must live there at the same time.

1.5 You cannot sublet (rent out) your entire home unless either:

* You own a 100% share

*You have your landlord’s permission, which they will only give in exceptional circumstances.

1.6 If you’re a serving member of the armed forces, and you’re required to serve away from the area where you live for a fixed period, you may sublet the entire home subject to the landlord’s permission.

2. Heylo Lease - 2.1 All shared ownership homes are sold as leasehold, even houses. This is because you only pay for part of the market value up front, and the landlord has an interest in the remaining share. If you reach 100% ownership, where possible, for most houses the freehold will transfer to you, and the shared ownership lease falls away. For most flats, the lease will remain in place, but the shared ownership obligations will fall away. For more information, see the ‘Maximum share you can own’ section in the ‘Key information about the home’ document.

2.2 You are buying a long leasehold interest in the home but only paying for part of the market value. The length of the lease is stated in the ‘Key information about the home’ document.

2.3 Information included within your lease:

2.3.1 A description of the home, including its boundaries.

2.3.2 Your responsibilities as a leaseholder, such as repairs and maintenance, and your landlord’s responsibilities, such as buildings insurance. For more information on repairs, see section 5, ‘Maintaining and living in the home’.

2.3.3 Details of any restrictions or obligations, such as decoration and alterations.

2.3.4 The lease start date.

2.3.5 The share that you have bought.

2.3.6 The amount of rent you must pay, together with any other amounts due under the lease.

2.3.7 How the landlord will review your rent.

2.3.8 The method by which you can buy additional shares to own more of your home in the future (staircasing).

2.3.9 The method by which you can move home, either by selling your share or selling the whole home.

2.4 As the lease is a legally binding contract, review it carefully with your solicitor. It’s important that you make sure that you understand the lease before you sign it. Your solicitor will provide you with a copy of the lease.

2.5 You’ll need to contact your landlord to confirm their lease extension policy.

3. Heylo Rent - 3.1 Under a shared ownership lease, you only pay for part of the market value up front, and you agree to pay rent on the remaining share to the landlord.

3.2 The total rent to pay at the start of the lease is based on the percentage of the remaining share of the market value you did not pay for. This percentage is noted in the ‘Summary of costs’ document. If you buy more shares in your home, the rent will go down.

3.3 The rent is reviewed on each Review Date whether or not you will have owned the property for a year at the date of the first Review Date. The Review Date is set out in the ‘Summary of costs’ document and in your lease. Depending on the terms of your lease, your rent will be reviewed by reference to either the Retail Price Index (RPI) or the Consumer Price Index (CPI). If the RPI measure of inflation is specified in your lease, then your rent will increase at the RPI rate plus 0.5%. If the CPI measure of inflation is specified in your lease, your rent will increase at the CPI rate, plus 1.0%. You can find out more information on the formula used to calculate how your rent increases in the ‘Rent Review’ section in the ‘Summary of Costs’ document. Your rent will in normal circumstances increase when it is reviewed . Your actual rent increase will be calculated each year and will usually

be based on the RPI or CPI increase and additional percentage set out in your lease. Your landlord will notify you each year what this amount will be. In the event of an RPI or a CPI decrease, your landlord does not have to decrease your rent and they may still increase it should an increase be possible once the additional percentage is taken into account.

3.4 Your lease will include the dates used for calculating the increase in RPI or CPI. For more information see the ‘Rent Review Period’ and ‘Rent Review’ sections in the ‘Summary of Costs’ document. A worked example demonstrating how the rent is calculated at review is also set out in Appendix 2 of the lease.

3.5 Your landlord may be entitled to terminate the lease

if you:

* do not pay the rent

* do not observe and perform your obligations in the lease. The landlord will need a court order to terminate the lease. If the landlord terminates the lease, you may lose any equity in the home you had bought. You could also lose any deposit or monies you have contributed towards the purchase of your home. If action is needed for non-payment of rent or breach of another obligation in the lease, the landlord will be obliged to make your mortgage lender aware of this. The mortgage lender may take their own action as they feel is appropriate.

3.6 When you complete (the day you buy your home), you will need to pay these costs for the rest of the month and possibly for the following month:

* rent

* service charge (where applicable)

* estate charge (where applicable)

* buildings insurance

* reserve fund (also known as ‘sinking fund’) payment (where applicable)

* management fee (where applicable)

Remember to plan for these amounts when you work out how much money you need for completion. You will receive a completion statement that explains what you need to do. Your solicitor will go through it with you.

For more information on what these costs are for, see ‘Your monthly payments to the landlord’ in the ‘Summary of costs’ document.

Rent Payable As Of August 2024 - The RICS valuation carried out on the 31st July 2024 confirms the property value at 100% is £370,000. As this property is being offered to market as a shared ownership of 50% the purchase price payable is £185,000 this is non-negotiable. A rent is payable monthly on the remaining 50% which as of August 2024 is a total of £427.17 per month, you are also liable for a lease management fee which as of August 2024 is £24.95 per month and annual buildings insurance which is currently as of August 2024 £12.80 per month, these are in addition to your mortgage payment.

Charges are subject to change/increase.

All charges stated correct at the time of publishing.

4. Heylo Other Costs - 4.1 You’ll need to make monthly payments to the landlord for the:

* rent

* service charge (where applicable)

* estate charge (where applicable)

* buildings insurance

* reserve fund (also known as ‘sinking fund’) payment (where applicable)

* management fee (where applicable) There is more information on the GOV.UK website about service charges and other expenses.

4.2 You’ll need to budget for your other monthly costs, which may include:

* mortgage repayment

* contents insurance

* Council Tax

* gas and electricity

* water

4.3 You may need to pay a reservation fee to secure your home. When you pay the fee, no one else will be able to reserve the home. Your landlord may have a policy on how long they will reserve a property before exchange of contracts. See the ‘Reservation fee’ section in the ‘Key information about the home’ document. If you go ahead and buy the home, the fee will be taken off the final amount you pay on completion.

4.4 You’ll need to pay a deposit towards your purchase:

* check with your solicitor when you need to pay the deposit

* check with your mortgage adviser when your first mortgage payment is due after completion

4.5 You’ll need to pay for your contents insurance. You’ll need to arrange this yourself before completion.

4.6 The landlord is responsible for the buildings insurance while you are a shared owner. This applies to both houses and flats. If you reach 100% ownership and remain a leaseholder, you’ll continue to pay the landlord for

buildings insurance. If you reach 100% ownership and become the freeholder, you’ll need to arrange buildings insurance yourself. To find out which of these apply, see the ‘Maximum share you can own’ section in the ‘Key information about the home’ document.

4.7 You’ll need to pay your own solicitors’ fees and any associated purchase costs. You can expect to pay fees including:

* legal services fee

* search costs

* banking charges

* Land Registry fee

* document pack fee

* management agent consent fee - subject to development and terms of the management company

* Solicitors’ fees can vary. Your solicitor should confirm what the fees cover and the cost when you instruct them to act on your behalf.

4.8 You may have to pay Stamp Duty Land Tax (SDLT) depending on your circumstances and the home’s market value. Discuss this with your solicitor. There is more guidance on the GOV.UK website:

* Stamp Duty Land Tax and shared ownership property

* Calculate Stamp Duty Land Tax (SDLT)

4.9 Remember to plan for these amounts when you work out how much money you need for completion. You will receive the following documents from your solicitor:

* an initial quote for the costs involved

* a completion statement after exchange of contracts, which describes the actual costs Your solicitor will go through these documents with you.

5. Heylo Maintaining And Living In The Home - This section describes the responsibilities for repairs and maintenance and who pays the costs.

5.1 As the leaseholder, you are responsible for keeping the home in good condition.

5.2 You are responsible for the cost of repairs and maintenance of the home. For information on help from the landlord with the cost of essential repairs in the first 10 years of the lease, see section 5.8, ‘Initial repair period’.

5.3 The landlord is not responsible for carrying out refurbishment or decorations. For example, replacing kitchens or bathrooms.

5.4 You are responsible for arranging and paying for a boiler service every year. The service must be carried out by an engineer on the Gas Safe Register.

5.5 Decoration and home improvements

5.5.1 You can paint, decorate and refurbish the home as you wish. For new-build homes, it’s better to not decorate for the first year though. This gives building materials like timber and plaster time to dry out and settle.

5.5.2 If you want to make any structural changes to your home, check with your landlord first to see if you need permission.

5.5.3 You’ll need to check with your landlord what counts as a home improvement and get permission before you carry out these works.

5.5.4 Home improvements may increase or decrease the market value of your home. How this affects you is covered in more detail in section 6, ‘Buying more shares’.

5.6 Responsibilities for maintaining the building

5.6.1 For new-build homes, the building warranty will cover the cost of structural repairs (typically for the first 10 or 12 years). You’ll need to check with the landlord who the building warranty provider is.

5.6.2 For flats, outside of the initial repair period (see section 5.8), the building owner (typically the landlord) will arrange external and structural repairs required. The cost will be divided between you and the other flat owners in the building, if the reserve fund does not cover the cost. Check with your solicitor to confirm what is in your lease.

5.6.3 If you buy a home through a shared ownership resale, any remaining period on the building warranty will transfer to you.

5.6.4 The service charge covers the items described in the ‘Summary of costs’ document. During the initial repair period, the landlord cannot use the service charge to cover external and structural repairs. After the initial repair period, the landlord will use the service charge to pay for the costs, unless they are covered by the repairs reserve fund.

5.7 Repairs reserve fund

5.7.1 If there is a reserve fund (also known as ‘sinking fund’), you will need to pay into the fund. The fund covers major works, like replacing the roof. There are rules about how landlords must manage these funds. You will not usually be able to get back any money you pay into them. For example, if you move home.

5.7.2 Repairs which are the landlord’s responsibility during the initial repair period will not be paid for using the reserve fund.

5.7.3 Refer to your ‘Summary of costs’ document to check if there is a reserve fund payment.

5.8 Initial repair period

5.8.1 There is a 10 year ‘initial repair period’ starting from the lease start date which applies while you own less than a 100% share in the home.

5.8.2 Any work that is covered by a warranty or guarantee must be claimed through the policy by the policyholder.

5.8.3 Repairs which are the landlord’s responsibility during the initial repair period will not be recharged through the service charge.

5.8.4 External and structural repairs

5.8.4.1 In the initial repair period, the landlord is responsible for the cost of essential repairs to:

* the external fabric of the building

* structural repairs to walls, floors, ceiling and stairs inside the home

5.8.4.2 These are limited to repairs not covered by the building warranty or any other guarantee. You must notify the landlord that the repair is required.

6. Heylo Buying More Shares - 6.1 You can buy more shares in your home. This is known as ‘staircasing’.

6.2 If you buy more shares in your home, the rent will go down.

6.3 Where you require legal advice when buying more shares, you are responsible for paying your own legal fees. Your mortgage lender will require you to instruct a solicitor if you are borrowing money to fund any purchase of additional shares. The landlord is responsible for paying their own legal fees related to share purchase transactions.

6.4 Buying shares of 5% or more

6.4.1 You can buy additional shares of 5% or more at any time.

6.4.2 You’ll need to know your home’s market value. You’ll need to pay for a valuation by a surveyor who is registered with the Royal Institution of Chartered Surveyors (RICS). The responsibility for who arranges the valuation (you or the landlord) is in the ‘Home valuation’ section of the ‘Summary of costs’ document. You can find a registered surveyor on the RICS website.

6.4.3 The landlord may charge an administration fee each time you buy a share of 5% or more. The fee is stated in the ‘Summary of costs’ document.

6.4.4 You will need to have your landlord’s permission to make home improvements.

6.4.5 If you have made home improvements, then your home valuation must show two amounts:

* the current market value - this is the home’s value including any increase because of home improvements

* the unimproved value - this is the home’s value ignoring the value added by any home improvements carried out

6.4.6 the price of additional shares of 5% or more is based on the unimproved value.

7. Heylo Selling Your Home - 7.1 You can sell your home at any time.

7.2 If you do not own 100% of your home, you must inform your landlord when you intend to sell your share.

7.3 If you do own 100% of your home, you can sell it on the open market. For example, through an estate agent.

7.4 Landlord’s first option to buy

7.4.1 When you give the landlord notice that you intend to sell your share in your home, the landlord has ‘first option to buy’. This means the landlord has a period of time to find a buyer. The period is specified in the ‘Key

information about the home’ document. (The landlord may offer to buy back your share, but only in exceptional circumstances and if they have funds available.)

7.4.2 If the landlord does not find a buyer within the specified period, you can sell your share yourself on the open market. For example, through an estate agent.

7.4.3 There are certain limited circumstances where the landlord’s first option to buy does not apply. These include the death of a leaseholder or if a court order requires you to transfer your ownership. You should ask your solicitor if you think these circumstances may apply.

7.4.4 The landlord’s first option to buy also does not apply once you own 100% of your home.

7.4.5 7.4.4 If your landlord finds a buyer during their period of first option to buy, the price will be no more than the current market value of your share of the home based on a RICS valuation.

7.5 Selling fees and costs

7.5.1 The landlord may charge you a fee when you sell your home. The cost is stated in the ‘Summary of costs’ document.

7.5.2 You are responsible for seeking legal advice when you sell your home. You will need to pay your legal fees.

7.6 Valuations

7.6.1 The sale price of your home is based on an RICS valuation.

7.6.2 For information on who is responsible for arranging and paying for the RICS valuation, see the ‘Summary of costs’ document.

Welcome to Poplar Place located on the new St Andrews Gardens development, Morpeth. A stunning detached house built in 2019 and presented to an excellent standard offering the perfect blend of modern living and comfort. This property has 4 bedrooms, ideal for a growing family or those in need of extra space, the master having its own ensuite shower room/wc. To the ground floor there is an open plan kitchen diner area, the kitchen having integrated appliances and a utility area, a separate lounge, a much sought after home office, hallway and ground floor/wc. Outside, the gardens are presented to an equally high standard and there is a garage and double length drive to the side.

St Andrews Gardens is well located for access to Morpeth Town Centre along with access to the A1 for those commuting a travelling further afield. Within Morpeth there is an excellent range of amenities including high street and local shops, cafes, bars and restaurants along with health and leisure facilities and schooling for all ages.

For further details please contact us after reading the attached information.

Entrance Hall - Entrance door to the front leading to a welcoming hallway with stairs leading to the first floor and radiator.

Ground Floor Wc - Fitted with a wc and wash hand basin. Radiator and extractor fan.

Lounge - 3.33 x 4.67 (10'11" x 15'3") - Double glazed french doors to the rear garden and patio area, radiator.

Additional Image -

Home Office / Study - 2.17 x 2.3 (7'1" x 7'6") - To the front elevation with a double glazed window to front and radiator.

Kitchen Diner - 3.88 x 2.87 exc. utility area (12'8" x 9'4" exc. u - The kitchen area is fitted with a range of wall and base units with works surfaces and breakfast bar and integrated appliances to include a dishwasher, fridge freezer, double oven and hob and extractor fan. To the utility area there are further units and an integrated washing machine, double glazed window to the rear and a radiator. The kitchen area also has a radiator and double glazed french doors leading to the rear garden.

Additional Image -

Dining Area - 2.82 x 2.87 (9'3" x 9'4") - Open plan from the kitchen area with a double glazed window to the front and a radiator.

First Floor Landing - Access to loft.

Master Bedroom - 3.45 x 3.41 exc. wardrobes (11'3" x 11'2" exc. war - A spacious main bedroom with double glazed window to the front, radiator and built in wardrobes.

Additional Image -

Ensuite - Fitted with a wash hand basin, wc and mains shower in cubicle. Double glazed window to front, radiator and extractor fan.

Bedroom Two - 2.9 x 3.58 (9'6" x 11'8") - Double glazed window to the rear, radiator.

Bedroom Three - 2.89 x 3.17 max (9'5" x 10'4" max) - Double glazed window to the front, radaitor.

Bedroom Four - 2.7 x 3.16 max (8'10" x 10'4" max) - Double glazed window to the rear, radiator.

Bathroom/Wc - Fitted with a wash hand basin, wc and a panelled bath. Double glazed window to rear, radiator and extractor fan.

Externally - The front of the property has a beautifully maintained garden with lawn and driveway to the side providing off street parking and access to the garage.

The rear of the property has a further, very well maintained garden with patio and lawn with well established borders.

Additional Image -

Additonal Image -

General Information - These particulars are produced in good faith, and are set out as a general guide only, they do not constitute part or all of an offer or contract.

The measurements indicated are supplied for guidance only and as such must be considered incorrect. Potential buyers are advised to recheck the measurements before committing to any expense. No apparatus, equipment, fixtures, fittings or services have been tested and it is the buyer’s responsibility to seek confirmation as to the working condition of any appliances.

As the agent we have not sought to verify the legal title of the property and verification must be obtained from a solicitor.

Fixtures and fittings that are specifically mentioned in these particulars are included in the sale, all others in the property are specifically excluded.

Photographs are produced for general information and it must not be inferred that any item is included for sale within the property.

Material Information - Material information is no substitute for professional advice, and consumers should be aware that the information collected may not accurately reflect the full extent of the property condition which would be covered through a home survey.

Efforts have been made to ascertain as much information as possible with regard to material information but this information is not exhaustive and cannot be fully relied upon, purchasers will need to seek further clarification from their legal advisor.

Electricity Supply - Mains

Water Supply - Mains

Sewerage - Mains

Heating - Mains GCH

Broadband and Mobile - Available - including Ultrafast & Superfast broadband. Mobile signal likely/limited with some providers. (Ofcom Broadband & Mobile Checker August 2024).

Flood Risk - Rivers & Sea - Very Low Risk. Surface Water - Very Low Risk. Source gov.uk August 2024.

Planning Permission - There is currently no active planning permissions for Poplar Place. For more information please see -Checked August 2024.

Coalfield & Mining Areas - The Coal Authority indicate that this property is located on a coalfield. Your legal advisor will be able to advise you of any implications of this.

Tenure & Council Tax Band - Leasehold - We cannot verify the Tenure of the property as we do not have access to the documentation. Purchasers must ask their legal advisor to confirm the Tenure.

We have been advised the lease term is 125 years from 2019 and 120 years currently remain. As of August 2024.

Council Tax Band: E Source gov.uk August 2024.

Mortgages - Why not make an appointment to speak to our Independent Mortgage Adviser?

PLEASE NOTE:

Your home may be repossessed if you do not keep up repayments on your mortgage.

Oracle Financial Planning Limited will Pay Rickard 1936 Ltd a referral fee on completion of any mortgage application.

Floor Plan - This plan is not to scale and is for identification purposes only.

Google Maps - General Note - If you are using Google Maps, satellite or Street View please be aware that these may not show any new development in the area of the property.

Viewing Arrangements - BY PRIOR ARRANGEMENT THROUGH OUR MORPETH OFFICE[use Contact Agent Button]

Heylo Key Criteria - Key criteria are:

* Buyers must be at least 18 years old.

* Buyers must have a total household income under £80,000 (£90,000 in London).

* Buyers must meet the Homes England affordability and sustainability assessments (see the Homes England calculator guidance for further information).

* Buyers are expected to use any savings and assets towards the purchase of their home. This may mean selling assets such as bonds, shares, land and any other financial investments.

* Buyers in receipt of benefits are eligible for Shared Ownership provided they meet the Homes England affordability assessment (not all benefits are eligible).

* Self-employed buyers must be able to provide 2-years evidence of their income.

Correct at time of publication - August 2024

* Buyers must purchase the maximum share they can reasonably afford within the parameters of the Homes England calculator.

* Shared owners must be first time buyers or:

* Not currently own a home suitable for their housing needs.

* Sell a home not suitable for their housing needs before buying Shared Ownership.

* Own a non-residential property that provides their main income source.

* Buyers must have good credit history and must not have the following (for more information on acceptable credit for Home Reach please refer to the credit policy):

* A mortgage or rent arrears

* Other bad debts

* County Court Judgements

* Buyers must have a minimum 5% deposit towards the share they are purchasing

* Buyers may retain a portion of their savings to cover the costs of purchase and moving home (typically up to £5,000). This may include:

* Legal fees

* Stamp Duty Land Tax where applicable

* Mortgage application fees

* Valuation fees and any associated moving costs

Heylo - Key Information About Shared Ownership - INTRODUCTION:

When you buy a home through shared ownership, you enter into a shared ownership lease. The lease is a legal agreement between you (the ‘leaseholder’) and the landlord. It sets out the rights and responsibilities of both parties.Before committing to buy a shared ownership property, you should ensure you take independent legal and financial advice.This key information document is to help you decide if shared ownership is right for you.You

should read this document carefully so that you understand what you are buying, and then keep it safe for future reference.It does not form part of the lease. You should carefully consider the information and the

accompanying lease, and discuss any issues with your solicitor before signing the lease.Failure to pay your rent or service charge or your mortgage could mean your house is at risk of repossession Examples and figures provided in this key information document are correct at the time of issue but will change over time in accordance with changes in house prices and the terms of the shared ownership lease.

1. Heylo How Shared Ownership Works - 1.1 You pay for a percentage share of the market value of a home. You enter into a lease agreement with the landlord, and agree to pay rent to the landlord on the remaining share.

1.2 You can buy more shares in your home, which is known as ‘staircasing’. This is covered in section 6,‘Buying more shares’.

1.3 When you buy more shares in your home, the rent you pay goes down in proportion to the landlord’s remaining share.

1.4 You can rent out a room in the home at any time, but you must live there at the same time.

1.5 You cannot sublet (rent out) your entire home unless either:

* You own a 100% share

*You have your landlord’s permission, which they will only give in exceptional circumstances.

1.6 If you’re a serving member of the armed forces, and you’re required to serve away from the area where you live for a fixed period, you may sublet the entire home subject to the landlord’s permission.

2. Heylo Lease - 2.1 All shared ownership homes are sold as leasehold, even houses. This is because you only pay for part of the market value up front, and the landlord has an interest in the remaining share. If you reach 100% ownership, where possible, for most houses the freehold will transfer to you, and the shared ownership lease falls away. For most flats, the lease will remain in place, but the shared ownership obligations will fall away. For more information, see the ‘Maximum share you can own’ section in the ‘Key information about the home’ document.

2.2 You are buying a long leasehold interest in the home but only paying for part of the market value. The length of the lease is stated in the ‘Key information about the home’ document.

2.3 Information included within your lease:

2.3.1 A description of the home, including its boundaries.

2.3.2 Your responsibilities as a leaseholder, such as repairs and maintenance, and your landlord’s responsibilities, such as buildings insurance. For more information on repairs, see section 5, ‘Maintaining and living in the home’.

2.3.3 Details of any restrictions or obligations, such as decoration and alterations.

2.3.4 The lease start date.

2.3.5 The share that you have bought.

2.3.6 The amount of rent you must pay, together with any other amounts due under the lease.

2.3.7 How the landlord will review your rent.

2.3.8 The method by which you can buy additional shares to own more of your home in the future (staircasing).

2.3.9 The method by which you can move home, either by selling your share or selling the whole home.

2.4 As the lease is a legally binding contract, review it carefully with your solicitor. It’s important that you make sure that you understand the lease before you sign it. Your solicitor will provide you with a copy of the lease.

2.5 You’ll need to contact your landlord to confirm their lease extension policy.

3. Heylo Rent - 3.1 Under a shared ownership lease, you only pay for part of the market value up front, and you agree to pay rent on the remaining share to the landlord.

3.2 The total rent to pay at the start of the lease is based on the percentage of the remaining share of the market value you did not pay for. This percentage is noted in the ‘Summary of costs’ document. If you buy more shares in your home, the rent will go down.

3.3 The rent is reviewed on each Review Date whether or not you will have owned the property for a year at the date of the first Review Date. The Review Date is set out in the ‘Summary of costs’ document and in your lease. Depending on the terms of your lease, your rent will be reviewed by reference to either the Retail Price Index (RPI) or the Consumer Price Index (CPI). If the RPI measure of inflation is specified in your lease, then your rent will increase at the RPI rate plus 0.5%. If the CPI measure of inflation is specified in your lease, your rent will increase at the CPI rate, plus 1.0%. You can find out more information on the formula used to calculate how your rent increases in the ‘Rent Review’ section in the ‘Summary of Costs’ document. Your rent will in normal circumstances increase when it is reviewed . Your actual rent increase will be calculated each year and will usually

be based on the RPI or CPI increase and additional percentage set out in your lease. Your landlord will notify you each year what this amount will be. In the event of an RPI or a CPI decrease, your landlord does not have to decrease your rent and they may still increase it should an increase be possible once the additional percentage is taken into account.

3.4 Your lease will include the dates used for calculating the increase in RPI or CPI. For more information see the ‘Rent Review Period’ and ‘Rent Review’ sections in the ‘Summary of Costs’ document. A worked example demonstrating how the rent is calculated at review is also set out in Appendix 2 of the lease.

3.5 Your landlord may be entitled to terminate the lease

if you:

* do not pay the rent

* do not observe and perform your obligations in the lease. The landlord will need a court order to terminate the lease. If the landlord terminates the lease, you may lose any equity in the home you had bought. You could also lose any deposit or monies you have contributed towards the purchase of your home. If action is needed for non-payment of rent or breach of another obligation in the lease, the landlord will be obliged to make your mortgage lender aware of this. The mortgage lender may take their own action as they feel is appropriate.

3.6 When you complete (the day you buy your home), you will need to pay these costs for the rest of the month and possibly for the following month:

* rent

* service charge (where applicable)

* estate charge (where applicable)

* buildings insurance

* reserve fund (also known as ‘sinking fund’) payment (where applicable)

* management fee (where applicable)

Remember to plan for these amounts when you work out how much money you need for completion. You will receive a completion statement that explains what you need to do. Your solicitor will go through it with you.

For more information on what these costs are for, see ‘Your monthly payments to the landlord’ in the ‘Summary of costs’ document.

Rent Payable As Of August 2024 - The RICS valuation carried out on the 31st July 2024 confirms the property value at 100% is £370,000. As this property is being offered to market as a shared ownership of 50% the purchase price payable is £185,000 this is non-negotiable. A rent is payable monthly on the remaining 50% which as of August 2024 is a total of £427.17 per month, you are also liable for a lease management fee which as of August 2024 is £24.95 per month and annual buildings insurance which is currently as of August 2024 £12.80 per month, these are in addition to your mortgage payment.

Charges are subject to change/increase.

All charges stated correct at the time of publishing.

4. Heylo Other Costs - 4.1 You’ll need to make monthly payments to the landlord for the:

* rent

* service charge (where applicable)

* estate charge (where applicable)

* buildings insurance

* reserve fund (also known as ‘sinking fund’) payment (where applicable)

* management fee (where applicable) There is more information on the GOV.UK website about service charges and other expenses.

4.2 You’ll need to budget for your other monthly costs, which may include:

* mortgage repayment

* contents insurance

* Council Tax

* gas and electricity

* water

4.3 You may need to pay a reservation fee to secure your home. When you pay the fee, no one else will be able to reserve the home. Your landlord may have a policy on how long they will reserve a property before exchange of contracts. See the ‘Reservation fee’ section in the ‘Key information about the home’ document. If you go ahead and buy the home, the fee will be taken off the final amount you pay on completion.

4.4 You’ll need to pay a deposit towards your purchase:

* check with your solicitor when you need to pay the deposit

* check with your mortgage adviser when your first mortgage payment is due after completion

4.5 You’ll need to pay for your contents insurance. You’ll need to arrange this yourself before completion.

4.6 The landlord is responsible for the buildings insurance while you are a shared owner. This applies to both houses and flats. If you reach 100% ownership and remain a leaseholder, you’ll continue to pay the landlord for

buildings insurance. If you reach 100% ownership and become the freeholder, you’ll need to arrange buildings insurance yourself. To find out which of these apply, see the ‘Maximum share you can own’ section in the ‘Key information about the home’ document.

4.7 You’ll need to pay your own solicitors’ fees and any associated purchase costs. You can expect to pay fees including:

* legal services fee

* search costs

* banking charges

* Land Registry fee

* document pack fee

* management agent consent fee - subject to development and terms of the management company

* Solicitors’ fees can vary. Your solicitor should confirm what the fees cover and the cost when you instruct them to act on your behalf.

4.8 You may have to pay Stamp Duty Land Tax (SDLT) depending on your circumstances and the home’s market value. Discuss this with your solicitor. There is more guidance on the GOV.UK website:

* Stamp Duty Land Tax and shared ownership property

* Calculate Stamp Duty Land Tax (SDLT)

4.9 Remember to plan for these amounts when you work out how much money you need for completion. You will receive the following documents from your solicitor:

* an initial quote for the costs involved

* a completion statement after exchange of contracts, which describes the actual costs Your solicitor will go through these documents with you.

5. Heylo Maintaining And Living In The Home - This section describes the responsibilities for repairs and maintenance and who pays the costs.

5.1 As the leaseholder, you are responsible for keeping the home in good condition.

5.2 You are responsible for the cost of repairs and maintenance of the home. For information on help from the landlord with the cost of essential repairs in the first 10 years of the lease, see section 5.8, ‘Initial repair period’.

5.3 The landlord is not responsible for carrying out refurbishment or decorations. For example, replacing kitchens or bathrooms.

5.4 You are responsible for arranging and paying for a boiler service every year. The service must be carried out by an engineer on the Gas Safe Register.

5.5 Decoration and home improvements

5.5.1 You can paint, decorate and refurbish the home as you wish. For new-build homes, it’s better to not decorate for the first year though. This gives building materials like timber and plaster time to dry out and settle.

5.5.2 If you want to make any structural changes to your home, check with your landlord first to see if you need permission.

5.5.3 You’ll need to check with your landlord what counts as a home improvement and get permission before you carry out these works.

5.5.4 Home improvements may increase or decrease the market value of your home. How this affects you is covered in more detail in section 6, ‘Buying more shares’.

5.6 Responsibilities for maintaining the building

5.6.1 For new-build homes, the building warranty will cover the cost of structural repairs (typically for the first 10 or 12 years). You’ll need to check with the landlord who the building warranty provider is.

5.6.2 For flats, outside of the initial repair period (see section 5.8), the building owner (typically the landlord) will arrange external and structural repairs required. The cost will be divided between you and the other flat owners in the building, if the reserve fund does not cover the cost. Check with your solicitor to confirm what is in your lease.

5.6.3 If you buy a home through a shared ownership resale, any remaining period on the building warranty will transfer to you.

5.6.4 The service charge covers the items described in the ‘Summary of costs’ document. During the initial repair period, the landlord cannot use the service charge to cover external and structural repairs. After the initial repair period, the landlord will use the service charge to pay for the costs, unless they are covered by the repairs reserve fund.

5.7 Repairs reserve fund

5.7.1 If there is a reserve fund (also known as ‘sinking fund’), you will need to pay into the fund. The fund covers major works, like replacing the roof. There are rules about how landlords must manage these funds. You will not usually be able to get back any money you pay into them. For example, if you move home.

5.7.2 Repairs which are the landlord’s responsibility during the initial repair period will not be paid for using the reserve fund.

5.7.3 Refer to your ‘Summary of costs’ document to check if there is a reserve fund payment.

5.8 Initial repair period

5.8.1 There is a 10 year ‘initial repair period’ starting from the lease start date which applies while you own less than a 100% share in the home.

5.8.2 Any work that is covered by a warranty or guarantee must be claimed through the policy by the policyholder.

5.8.3 Repairs which are the landlord’s responsibility during the initial repair period will not be recharged through the service charge.

5.8.4 External and structural repairs

5.8.4.1 In the initial repair period, the landlord is responsible for the cost of essential repairs to:

* the external fabric of the building

* structural repairs to walls, floors, ceiling and stairs inside the home

5.8.4.2 These are limited to repairs not covered by the building warranty or any other guarantee. You must notify the landlord that the repair is required.

6. Heylo Buying More Shares - 6.1 You can buy more shares in your home. This is known as ‘staircasing’.

6.2 If you buy more shares in your home, the rent will go down.

6.3 Where you require legal advice when buying more shares, you are responsible for paying your own legal fees. Your mortgage lender will require you to instruct a solicitor if you are borrowing money to fund any purchase of additional shares. The landlord is responsible for paying their own legal fees related to share purchase transactions.

6.4 Buying shares of 5% or more

6.4.1 You can buy additional shares of 5% or more at any time.

6.4.2 You’ll need to know your home’s market value. You’ll need to pay for a valuation by a surveyor who is registered with the Royal Institution of Chartered Surveyors (RICS). The responsibility for who arranges the valuation (you or the landlord) is in the ‘Home valuation’ section of the ‘Summary of costs’ document. You can find a registered surveyor on the RICS website.

6.4.3 The landlord may charge an administration fee each time you buy a share of 5% or more. The fee is stated in the ‘Summary of costs’ document.

6.4.4 You will need to have your landlord’s permission to make home improvements.

6.4.5 If you have made home improvements, then your home valuation must show two amounts:

* the current market value - this is the home’s value including any increase because of home improvements

* the unimproved value - this is the home’s value ignoring the value added by any home improvements carried out

6.4.6 the price of additional shares of 5% or more is based on the unimproved value.

7. Heylo Selling Your Home - 7.1 You can sell your home at any time.

7.2 If you do not own 100% of your home, you must inform your landlord when you intend to sell your share.

7.3 If you do own 100% of your home, you can sell it on the open market. For example, through an estate agent.

7.4 Landlord’s first option to buy

7.4.1 When you give the landlord notice that you intend to sell your share in your home, the landlord has ‘first option to buy’. This means the landlord has a period of time to find a buyer. The period is specified in the ‘Key

information about the home’ document. (The landlord may offer to buy back your share, but only in exceptional circumstances and if they have funds available.)

7.4.2 If the landlord does not find a buyer within the specified period, you can sell your share yourself on the open market. For example, through an estate agent.

7.4.3 There are certain limited circumstances where the landlord’s first option to buy does not apply. These include the death of a leaseholder or if a court order requires you to transfer your ownership. You should ask your solicitor if you think these circumstances may apply.

7.4.4 The landlord’s first option to buy also does not apply once you own 100% of your home.

7.4.5 7.4.4 If your landlord finds a buyer during their period of first option to buy, the price will be no more than the current market value of your share of the home based on a RICS valuation.

7.5 Selling fees and costs

7.5.1 The landlord may charge you a fee when you sell your home. The cost is stated in the ‘Summary of costs’ document.

7.5.2 You are responsible for seeking legal advice when you sell your home. You will need to pay your legal fees.

7.6 Valuations

7.6.1 The sale price of your home is based on an RICS valuation.

7.6.2 For information on who is responsible for arranging and paying for the RICS valuation, see the ‘Summary of costs’ document.

Property information from this agent

About this agent

Welcome to Rickard Chartered Surveyors When you're looking to buy, sell or let property, Rickard can help. Whether you need a survey, valuation, mortgage or property management service, we have the people, the experience and the local knowledge to give you the best advice and service. We've been in the property business since 1936, so well understand the needs of our customers, and we work hard to meet those needs quickly, efficiently and cost effectively.